After G-d promises Avraham to give him 'this land to inherit', Avraham questions, במה אדע — 'Whereby shall I know to inherit it?'

He is then instructed to bring animals and perform a ritual to seal the covenant that G-d will redeem his offspring after four generations as aliens in a foreign land, having served their hosts under oppression.

The Talmud in Nedarim (32b) quotes Shmuel who explains that the sentencing of Avraham's children to endure the exile in Egypt was a punishment for his having questioned G-d's ways, doubting whether they would indeed be redeemed.

The Talmud brings two other opinions as to why they were enslaved in Egypt for two hundred and ten years.

Rabbi Avahu says it was it was because he drafted his Torah students to fight the war against the four kings and save Lot.

Rabbi Yochanan avers it was due to Avraham having returned the citizens of Sodom to their king, instead of keeping them to bring them to serve G-d, that Avraham's offspring were destined for exile.

Rabbeinu Asher, in his commentary on the Talmud adds that although it seems clear from the Torah that the sojourn in Egypt was a response to Avraham's questioning G-d's promise when uttered, במה אדע — How can I know they will survive, in clear contradiction to Shmuel and Rabbi Avahu who attribute it to other errors, they are all nevertheless true.

He explains that it was those two 'sins' that created the setting for him to err in expressing doubt.

They would seem to be three independent failures unrelated to each other.

How do we understand the connection between the three?

We are living in challenging times.

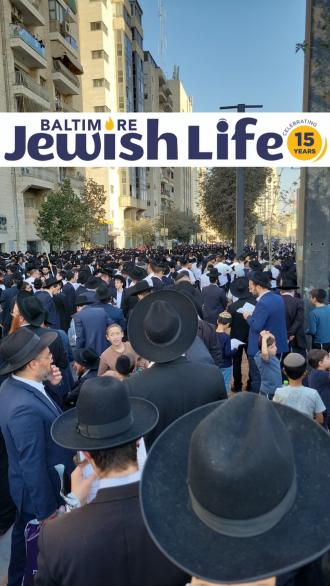

This week the 'Million Man' demonstration took place in Yerushalaim, with at least several hundred thousand people joining to support the right and imperative to maintain the Yeshiva system and its students' exclusive devotion to Torah study, exempting them from other communal obligations, most significantly conscription to the IDF.

At the same time there are many who vehemently protest this notion, demanding equal responsibility without exception. Many of those in this camp are far removed from tradition and certainly from exposure to Torah and those who study it.

And betwixt these two factions there are those who embody devotion to Torah but feel compelled to serve proudly fulfilling their mission to protect the Jewish people and their beloved land. These noble soldiers are, unfortunately, not always shown the appreciation they deserve from their partners who protect our land with the merit of Torah study which we are taught is what fuels our very existence. Were there ever a moment where Torah study ceased, the world would revert to תהו ובהו — astonishing emptiness.

The Maharal famously taught, דברים גדולים אינם במקרה — Great things do not happen by happenstance.

Look to the rock you were hewn from… (Yeshayahu 51) This refers to Avraham Avinu.

Avraham had lapsed in his appreciation of the power of Torah to right the world simply due to its inherent power. A world where Torah is studied in its purest motivation, preempts natural law. There would be no need for war since the radiance of Torah study would permeate each of our souls, enabling our souls to influence humanity towards decency and morality.

That slight flaw in the blueprint of our nation would be corrected through enduring challenge and rising through those struggles towards perfection and becoming the embodiment of Torah in the world.

Perhaps that lack of a clear perception of the strength of Torah, that can influence even those so distant from morality — as the inhabitants of Sodom, was reflected in Avraham's reticence to preserve the captives in his own embrace.

These two subtle deficiencies were the subtext of Avraham's expression, במה אדע — How can I know they will survive.

Avraham exhibited a moment of self-doubt, wondering whether he was deserving and capable of upholding this covenant with G-d, projecting that lack of confidence upon his future progenies.

Were Avraham to have manifested his belief in himself to carry out his mission and succeed, it would have become ingrained into every rock that was hewn from him.

It would have produced flawless monuments to his greatness that would never have to resort to warfare, merely relying on the power of pure Torah affecting all those absorbing its rays.

We are still engaged in that process of perfection. We can only hope to reach that level of purity in our mission if we correct that lapse of faith in others, no matter how distant, to be drawn unto the light of Torah. Without gratitude to those who preserve our lives — protecting us with the 'book and the sword enwrapped in their hand' until such time as we reach the pinnacle of Avraham's striving — we cannot achieve our goal.

It is only with the attribute of the חסד — kindness of Avraham that we can fulfill our mission.

It will happen. We have what it takes. G-d made a covenant, but it is up to us to bring it all home.

Soon in our days!

באהבה,

צבי יהודה טייכמאן