Holiday cheer, and perhaps the first sign of an anticipated Santa Claus rally, came early to Wall Street on Wednesday when the Federal Open Market Committee delivered a long-awaited interest-rate increase.

The Dow Jones Industrial Average rose 223 points or 1.28% to 17748. The S&P 500 gained 29 points, or 1.45% to 2072, while the Nasdaq Composite added 75 points, or 1.52% to 5071.

Energy was the only sector in negative territory, as utilities staged the biggest rally.

Today’s Markets

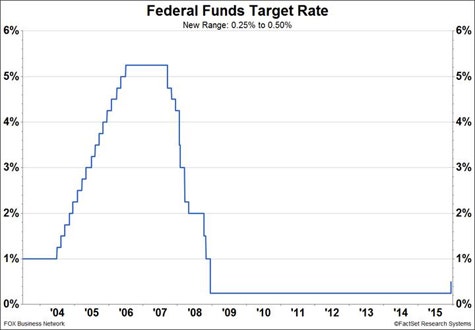

In an historic decision at the conclusion of a two-day policy meeting, the Federal Reserve said it will raise short-term interest rates by 0.25 percentage point from a near-zero range for the first time in nearly a decade. The decision was widely anticipated by Wall Street, and sent U.S. equity markets higher.

In its statement, the central bank said economic activity expanded at a “moderate” pace while household spending and business investment increased at “solid rates” over recent months.

“A range of recent labor market indicators, including ongoing job gains and declining unemployment, shows further improvement and confirms that underutilization of labor resources has diminished appreciably since early this year. Inflation has continued to run below the Committee's 2% longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports,” the statement read.

The committee also noted, though, that “market-based measures of inflation compensation remain low; some survey-based measures of longer-term inflation expectations have edged down.”

Still, in her press conference immediately following the FOMC’s decision, Fed Chief Janet Yellen said unequivocally the decision “reflects our confidence in the U.S. economy.”

To that point, Brad Friedlander of Angel Oak Capital Advisors, which has $6 billion in assets under management, said the Fed’s decision was the right move.

“I applaud them for being able to sift through the data and really see through the fog of credit-market jitters, other concerns within the marketplace,” he said. “The statement was well balanced, while still erring on the side of dovish…there were really no big surprises.”

He said the Fed had the ammunition to move rates higher at its September meeting, though it opted not to due to a slew of economic events that presented a downside risk to the economy including a slowdown in China, a stronger dollar, and weaker domestic data.

In its economic projections summary, the Fed outlined its median fed funds projection to be 1.4% by the end of next year, which equates to three to four hikes in the interim period.

But for the central bank, communication is essential as markets are quick to react to any slight change in the policy statement going forward, and likely to read between the statement’s lines.

To that point, Scott Colyer, CEO of Advisors Asset Management, said the Fed’s forward guidance will be in overdrive from this point on.

“Forward guidance is critically important to the marketplace. They don’t want to provide any shocks…[Yellen] is talking about a gradual increase, the trajectory of the increase will be more important to the market on a going-forward basis,” he said.

In recent action, the yield on the benchmark 10-year Treasury bond rose 0.028 percentage point to 2.294%. Meanwhile, the two-year yield touched 1% for the first time since May 2010 as traders parsed the decision to raise the Fed Funds rate for the first time in nearly a decade.

In currencies, the U.S. dollar spiked following the decision.

From a consumer standpoint, Greg McBride, chief financial analyst at Bankrate, wrote in a note on Wednesday that a small change in interest rates affects not only the average American’s 401(k) thanks to stock-market reaction, but also in other ways including large-scale investments.

“The initial interest-rate move will be very modest with consumers seeing a corresponding increase in their credit card and home-equity line of credit rates within one to two statement cycles,” he said. “But the significance is in the potential cumulative impact of whatever interest-rate hikes are put into effect over the next 18-24 months.’

Commodities have seen volatile gyrations over the last couple of weeks, especially in the oil market after OPEC decided last Friday to keep production at current levels, rather than cut back to try and alleviate pressure on the market. Prices plunged to fresh 2009-era lows as worries grew over how long the global supply glut will last.

Crude came under selling pressure again on Wednesday after data from the Energy Information Agency showed an unexpected build in U.S. crude oil stockpiles.

In recent action, West Texas Intermediate crude prices plunged 4.90% to $35.52 a barrel, while Brent, the international benchmark, eased 3.28% to $37.19 a barrel.

Colyer said the volatility in the energy market is likely to hang around as OPEC and non-OPEC producers find a way out of the global oversupply problem. He said actually, the U.S. moving on a pace of tightening monetary policy could help encourage other nations easing now, feel more confident to move in tandem with the U.S. as the global economy recovers. And that, he said, has a positive impact on oil prices in the long run.

“Once you see a global bounce, it’ll help create demand to cause commoditiy prices to bounce, which will be good for the U.S. What that does to the Fed’s position is help them hit their inflation target a little quicker. The first part of 2016 looks to be a little flat, but the last part we could see some inflation pressure.”

Elsewhere, metals were higher as gold rose 1.42% to $1,078 a troy ounce. Silver gained 3.48% to $14.22, while copper added 0.49% to $2.06 a pound.